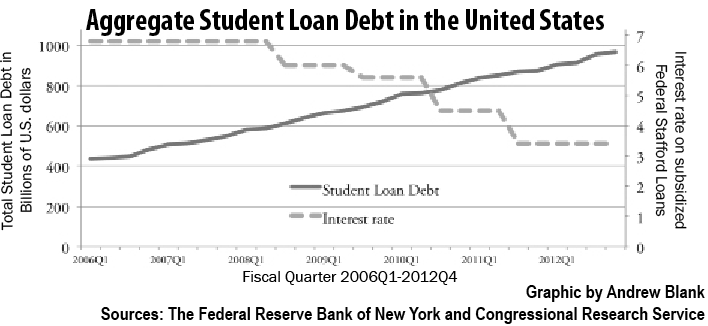

The interest rate on federally-subsidized Stafford loans is scheduled to double from 3.4 percent to 6.8 percent barring any Congressional action by July 1, according to the Congressional Research Service. The loans are made by the federal government exclusively to undergraduate students who demonstrate financial need up to a maximum of $23,000 in cumulative loan debt.

Beth Maglione, spokesperson for the National Association of Student Financial Aid Administrators, said she was optimistic about a legislative fix from Congress before July on the interest rate, which impacts low-income borrowers.

“We’re really pleased and heartened to see bipartisan support for finding a permanent, sustainable solution to federal student-loan interest rate [issues] that would also stop the subsidized Stafford loan [interest rates] from doubling from 3.4 to 6.8 percent this July,” Maglione said.

The federally-subsidized loans were set to double one year ago, but Congress passed a measure to postpone a rate increase until this summer. Maglione added that she thinks because Congress intervened last year, it would work out either a solution or extension before the deadline again this year.

State Representative Cheri Bustos introduced legislation to extend the current interest rate on federally-subsidized Stafford loans for two years.

According to a February report released by the Congressional Budget Office, the U.S. federal government will accrue 12.5 cents in revenue next year for every dollar lent through subsidized Staffords next year.

Maglione added that her organization has testified before Congress on behalf of a plan to change the interest-rate from fixed and Congressionally determined to variable and market-based and that this would be a “considerably better deal for students and their families.”

“Any interest rate going from 3.4 to 6.8, 6.8 is higher than you would pay for a mortgage right now,” said Maglione. “That is not desirable. That is not based on what the market can bear.”