Having ‘the talk’ about college finances

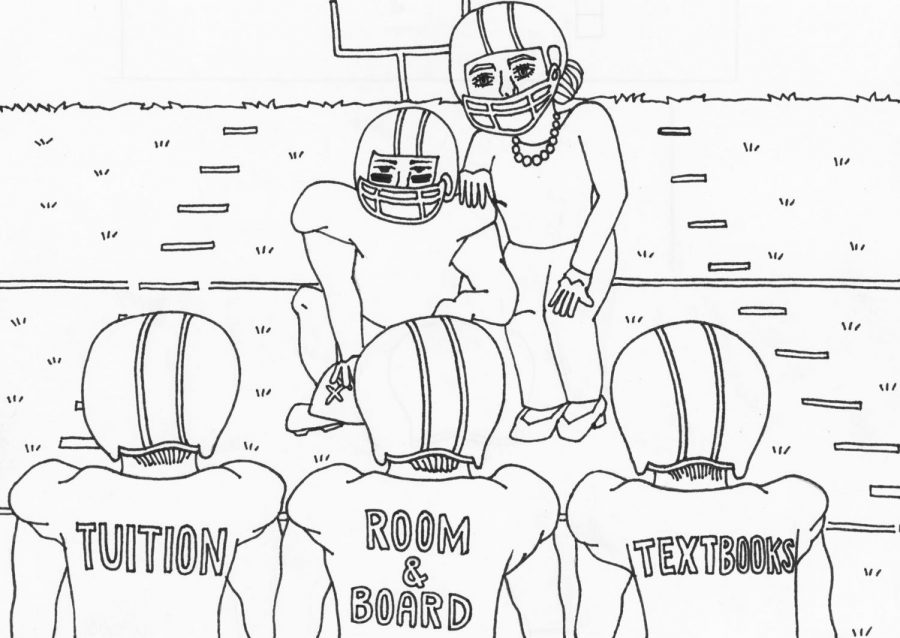

Together, a student and parent face off against major costs of college in a football game. David Boyle, coordinator of college counseling at Glenbrook North said the student should be the quarterback of the college selection process, but the parents need to be involved in financial decisions.

Despite attending presentations about paying for college, senior Thane Gesite felt confused about the college financial aid process. She had little guidance from her parents, who had not been through the college financial process in the United States, which made it difficult for her to address the topic.

“There was a total lack of communication,” said Gesite. “I thought my dad took care of [the College Scholarship Service Profile], but he had never heard of it before.”

David Boyle, coordinator of college counseling at Glenbrook North, said the conversation about paying for college should start when GBN officially launches the college process in November of the student’s junior year.

Paula Bishop, financial aid for college advisor, said in a phone interview that when planning the conversation about financial aid, students should schedule a time to talk with their parents.

“To be ready for this meeting with [your parents], you should have an idea on what kinds of schools you want to go to and then look at the cost of attendance on their website,” said Bishop. “Don’t just look at tuition.”

Boyle said the cost of attendance includes everything that the university or college is going to charge a student.

“It includes tuition, room and board, general fees, insurance fees, student-activities fees and any kind of fee that the institution is going to charge,” Boyle said.

Bishop said students should try the net price calculators on each college’s website to estimate the possible aid they might receive.

The net price calculator helps a lot because a student will have an idea of how much they might need to pay, said Bishop.

Boyle said the conversation between parents and students can include the following questions: How much are the parents willing to put forth for education? Is it a set amount per year? Is it a total set amount? Can that money be supplemented with scholarships?

“The conversation is not so much a formulaic conversation, it’s more of a general understanding,” said Boyle. “So as the student goes out and learns about how much schools cost, they have a plan [for financing college].”

Boyle said the overall discussion should also include the value of the education compared to the monetary price.

“Sometimes parents will come to me and say, ‘I am willing to spend “x” for one university but not “x” for another university,’” Boyle said.

Bishop said students should also communicate their role in the process of financing college.

“Tell the parents that the student is willing to help by getting good grades to hopefully be eligible for merit awards at some colleges and also be willing to take out a student loan to help,” Bishop said.

Gesite said in the future she would keep the communication strong by initiating the conversation and making sure both parties are updated.

“That was my first mistake — just ignoring the conversation,” Gesite said.